Wake County Property Tax Rate 2024 Changes List – Wake County’s property tax rate for 2024 is .657 cents per $100 of property value, according to the country. The revenue neutral rate at the new appraisals would be .4643 cents per $100 of value. . Around 8,000 potential jobs are in the pipeline as the Wake County Economic Development team works to secure new investments in the Raleigh region in 2024 like interest rates and the cost .

Wake County Property Tax Rate 2024 Changes List

Source : www.wake.gov

Wake County unanimously passes $1.8 billion budget, property tax

Source : www.wral.com

Tax Administration updates leaders on Wake County property

Source : www.wake.gov

How to appeal the assessed property value of your Wake County home

Source : www.wral.com

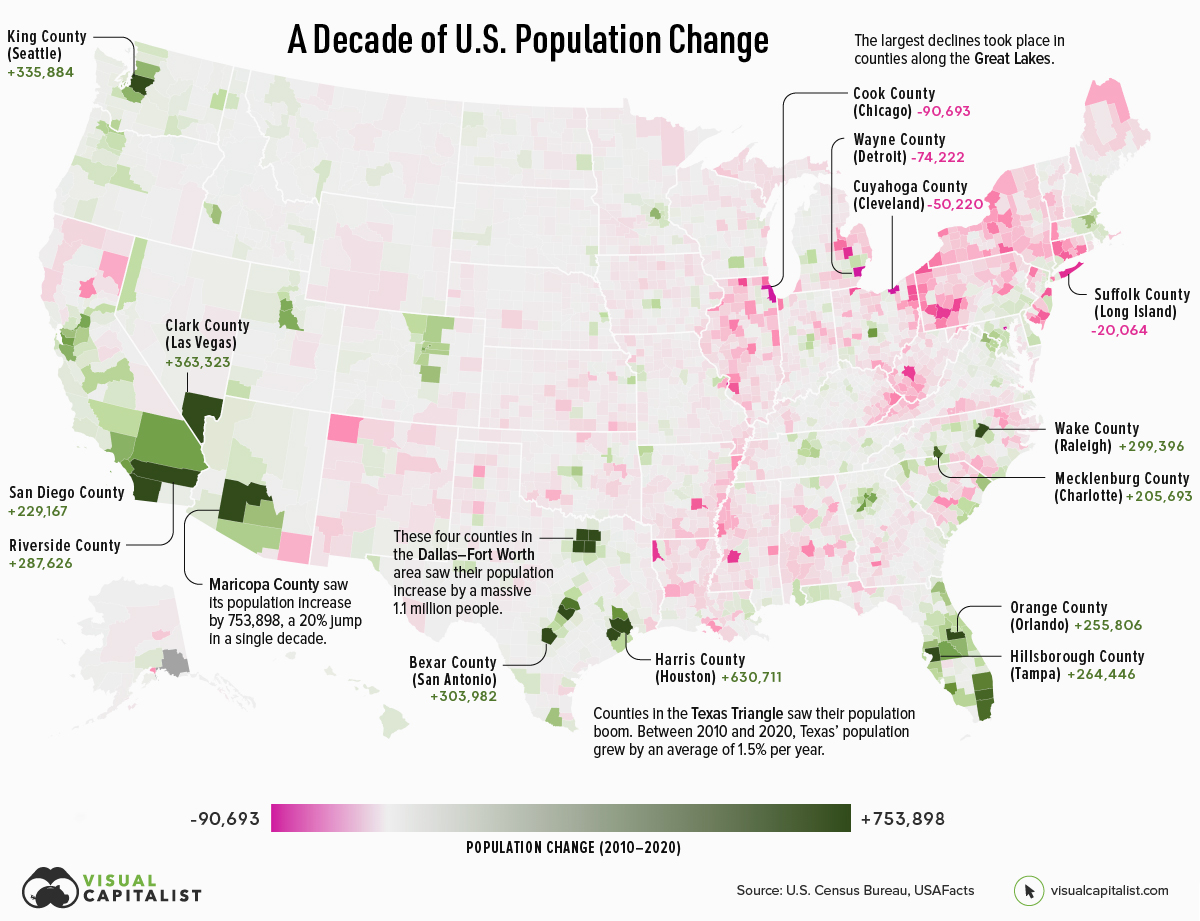

Mapped: A Decade of Population Growth and Decline in U.S. Counties

Source : www.visualcapitalist.com

Wake County unanimously passes $1.8 billion budget, property tax

Source : www.wral.com

Tax Administration updates leaders on Wake County property

Source : www.wake.gov

Expert on how to appeal rising property values in Wake County

Source : www.cbs17.com

Departments & Government | Wake County Government

Source : www.wake.gov

A landslide of contaminated soil threatens environmental disaster

Source : www.cbs17.com

Wake County Property Tax Rate 2024 Changes List Tax Administration updates leaders on Wake County property : said at Tuesday’s reorganization meeting that while the county’s property tax rate will “freeze” in 2024, the county will embark on new programs to aid local municipalities. Kuhl, who previously . Wake County voters could see a nearly $100 million “We went looking for property in that area to put a library on and we just couldn’t find any with a suitable price that we were willing .